Well, looking at KLCI that move up higher and higher is a very tiring process especially when already sold out most of the stock in my portfolio. So I decided to buy in some hidden gems again. This time the stock is MARCO. http://www.marcoholdings.com.my

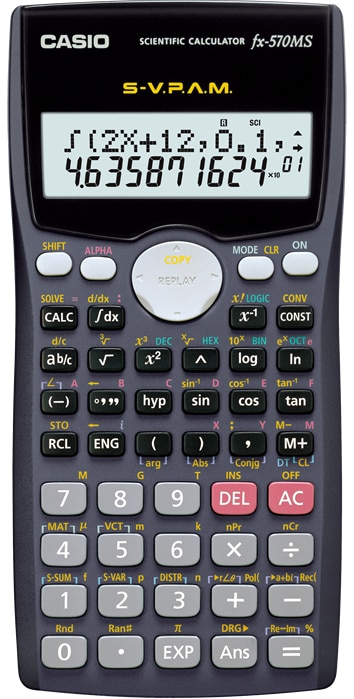

Marco Holdings Berhad is a Malaysia-based company engaged in investment holding and the provision of management services to its subsidiaries. The Company, through its subsidiaries, is engaged in the distribution of electronic calculators and timepiece including the brand of Casio, Catterpilar, Movado, Hush Puppies and Dunlop . Within 5 years from 2007, Marco's eps from 0.56 cent had rise to almost four times at 2.04cent in 2012.

MARCO's major operation can be divided into local market and regional market (thailand, singapore, vietnam, brunei, cambodia, myammar). In local market, it is further divided into timepiece division, calculator division and musical keyboard and digital camera division. In 2012, timepiece division's revenue covered 56%, calculator division covered16%, musical keyboard and digital camera division covered by 7% and regional market covered 21%.

Since Malaysia government started to distribute BRIM in 2012 to students from all level including primary, secondary and tertiary, this drived MARCO's calculator division revenue to rise 4.2million or 29% from 14.2million in 2011 to 18.6million in 2012. Although calculator division is only the third contributor,I believed Marco's Casio calculator has indispencible position in Malaysian education system. I personally have few of this and still usable until this days. I bet every Malaysian have one because it has become a neccessity in studying Mathematics in the secondary.

SWOT Analysis

Strength

1. Marco has operated since 1972 and 41 years of experience prove the company can go through any economy crisis.

2. Government every year provide book voucher and allowance for students to buy stationary and indirectly increase the purchase of calculators.

3. Casio calculator is well known for its quality and long lasting which increase its brand awareness.

4. The table for quarter financial result above shows a steady increase in EPS proving that the company is in the right track.

5. The dividend given in 2012 was 1.4 cent which equivalent to DY of 9% based on share price of 15 cent.

6. The company is cash rich with 5.6 cent per share equivalent to more than 30% of the share price.

7. Casio calculator is the main preference for all secondary and tertiary students.

8. Marco had achieved positive earning since 2002 and continue to increase in EPS according to http://klse.i3investor.com/servlets/stk/fin/3514.jsp

Weakness

1. Marco does not possess the monopoly in the market as consumer can get Casio from other suppliers.

2. There will be competitors for its watches since Marco only distribute few brands.

3. Marco's warrant will reach due date in 2014 and will sure dilute its EPS. Marco's share issued is 794,589,500 units, Marco's wa is 272,484,780 units. Let say all the WA is exercised and the total share unit will be 1,067,074,280. If company maintain the profit like 2012 which was RM14,872,000, then EPS will be RM14,872,000/1,067,074,280= RM0.139 which still make MARCO's PE around 10 now.

Opportunity

1. The number of students in Malaysia is the potential client for Marco's calculator.

Number of students in Malaysia

Boy Girl

Preschool 97,158 94,784

Primary 1,411,082 1,332,067

Secondary 1,134,792 1,144,378

Total 2,643,032 2,571,229

Total amount : 5,214,261

source :http://www.moe.gov.my/

2. Government had assure there will be BRIM for students annually increasing student's purchasing power.

Threat

1. Economy downturn decreasing sales of Marco's watches and calculators.

2. Government may not be able to continue BRIM for long term.

In the process of studying this stock, I even email Marco to ask about their operation and I did get the reply rather fast from the head of marketing department as below:

My email:

Hi, I am one of the new share holder of Marco Holding Bhd. I read through your website and annual report but I failed to confirm whether Marco is the sole distributor for Casio product in Malaysia or in this South East Asia region. Is Marco the only distributor for Casio calculator?

In the list provided in the website did not include established bookstore such as Popular Book store, MPH, Smart Book shop and larger chain of book store that I think Marco can further explore into to increase market share in calculators. If Marco can monopoly the supply of Casio product, I believe the revenue and profit will increase tremendously.

Marco's reply:

My name is Lam Wai Khuen & I am appointed Head of Department of Sales & Marketing for Marco Corporation.

The core product that I am handling is CASIO watches & calculators product

Marco are indeed the official authorised distributor for CASIO (Timepiece, Calculators, Musical Instrument & Digital Camera) in Malaysia.

Under the current practices by CASIO Computer, they have not been encouraging their authorised distributors to use the term called "sole distributors" for reasons.

The recognized all their appointed partner as DMD (Domestic Marketing Distributor).

To clear the doubts, yes we are the only appointed distributor in Malaysia

Please refer to the web link (by CASIO) mentioned below:

For Watches: http://www.casio-intl.com/asia-mea/en/support/sales/wat/

For Calculators: http://www.casio-intl.com/asia-mea/en/support/sales/calc/

For Camera: http://www.casio-intl.com/asia-mea/en/support/sales/dc/

For Musical Instrument: http://www.casio-intl.com/asia-mea/en/support/sales/emi/

We are currently supplying to your mentioned key resellers.

In our distribution channel, supplying of product could be either direct or indirect approach.

Off course, we which we preferred direct supplying as we have more control of the supply & execution of marketing activities.

But there are some retailers tends to consolidate the suppliers & only work with certain appointed company to supply.

Under such icircumstances, we have to opt for the indirect supplying approach.

The product that supplied by Marco Group of Companies are instantly recognized upon via the imports stickers which mentioned of "Diimport Oleh"

Next to be trace, it our warranty card issued by MARCO.

As benefit to an appointed DMD, we are supplied with rare or limited editions to maximized our sales.

Also, we are supported with marketing fund to executed CASIO global marketing events such Shock The World Promotional Tour & sales campaign which ultimately benefit the brand & profitability to the business.

Along our progress, we as DMD is authorized to set up flagship store for CASIO (Timepiece) under the tradename called G-Factory

Monopoly market doesnt exist for CASIO products.

Parallel importations or grey marketeers do exist & this are not new scene in distribution trade.

Eg: In automobile industrial: you have the AP to import car, in phone industry: AP units & others consumer or electronic goods.

We sincerely, hope the above would clarify to your thoughts and continue to provide you the confidences as share holder to Marco Holding Berhad.

Thank you.

Best regards,

Lam Wai Khuen

My side income is here, please click....Thanks.

Friday, 26 July 2013

Thursday, 18 July 2013

Time line of a the 2008 Sub Prime Mortgage Crisis.

Tuesday, 16 July 2013

Reduce mistake

Just had a simple talk on investment strategy with my second brother last weekend. We talked about his early investment route that cost him more than 10k loses. He stepped into Klse right before the 2008 Great Depression and got out of control when he chose to buy cheap warrant stocks. At that time, I still haven't start my investment since still study in university.

Cheap plus warrant is simply the fastest way to lose money. Warrant is just issue for certain time and one who buy this must be ready to exercise it. Although I had invested in stock market for more than two years, I still haven't confident with warrant so I choose not to touch it. My brother could have avoid such loses if he did not buy something he not clear with.

Cheap plus warrant is simply the fastest way to lose money. Warrant is just issue for certain time and one who buy this must be ready to exercise it. Although I had invested in stock market for more than two years, I still haven't confident with warrant so I choose not to touch it. My brother could have avoid such loses if he did not buy something he not clear with.

Saturday, 13 July 2013

Plantation counters

Well, it looks like CPO future is reducing in fast pace. Just surfing around and found this website that I think is pretty good with its news and data. http://www.palmoilhq.com/palm-oil-plantation-stocks/ .

Prediction vs reality

Hmm, look like my prediction is again wrong on the market. With Bank Negara tighten the borrowing last Friday, BNM did not take further action to cool off the property sector since the OPR is still set at 3% yesterday. With the rate still the same, I think those who afford will still use property as their investment tool since the current rule only limit housing loan repayment up to 35 years that is certainly not affecting the rich investor.

I believe nothing in the world can continue to increase without stop. Remember few years back, we used to believe gold and crude oil will continue to surge up high and will not come down again. Look at those commodity now, this prediction surely did not fit in the reality. It will all go back to demand and supply. With intermediate double storey terrace house reaching half million and semi detached easily reach more than million, this is definitely not fitting with the current average household income in my home town. Every now and then, people keep on advising me that if not buying now then it will be hard to buy again next time. That definitely sound very familiar with any bubble in the past. Property sectors is cylindrical and the price is already beyond the affordability of most household. I just stick with my prediction and wait the reality to review itself in future.

I believe nothing in the world can continue to increase without stop. Remember few years back, we used to believe gold and crude oil will continue to surge up high and will not come down again. Look at those commodity now, this prediction surely did not fit in the reality. It will all go back to demand and supply. With intermediate double storey terrace house reaching half million and semi detached easily reach more than million, this is definitely not fitting with the current average household income in my home town. Every now and then, people keep on advising me that if not buying now then it will be hard to buy again next time. That definitely sound very familiar with any bubble in the past. Property sectors is cylindrical and the price is already beyond the affordability of most household. I just stick with my prediction and wait the reality to review itself in future.

Thursday, 4 July 2013

Continue clearing my portfolio

Today clear off my panamy that was with me for almost two year. My average was 21.5 and receive almost RM200 of dividend last year. Overall, I gained another 1k plus and quite happy with it although I know it may increase some more later on since it looks like bullish every where now.

When everyone believe in uptrend and getting greedy, we must be well prepare that any time there will be a correction coming soon. I am sure there will be quite some happy hour later and more people are already forgetting what happened last few weeks. I am sure the drop will come soon, if not because of foreign sell off, it will also be the Hari Raya calendar effect since fund manager usually sold off some counters before going off for holiday. Besides the gain from Panamy, I also manage to gain few hundreds from trading on Yeelee but it seems to be selling a little bit too early.

Raya cheap sale is what I waiting for and at the same time, there are just too many factors can change the stock market currently including the Turkey political stability, Us employment rate, Europe Central bank decision on interest rate, Japanese president election and so on. Lets see what happen next.

When everyone believe in uptrend and getting greedy, we must be well prepare that any time there will be a correction coming soon. I am sure there will be quite some happy hour later and more people are already forgetting what happened last few weeks. I am sure the drop will come soon, if not because of foreign sell off, it will also be the Hari Raya calendar effect since fund manager usually sold off some counters before going off for holiday. Besides the gain from Panamy, I also manage to gain few hundreds from trading on Yeelee but it seems to be selling a little bit too early.

Raya cheap sale is what I waiting for and at the same time, there are just too many factors can change the stock market currently including the Turkey political stability, Us employment rate, Europe Central bank decision on interest rate, Japanese president election and so on. Lets see what happen next.

Subscribe to:

Comments (Atom)